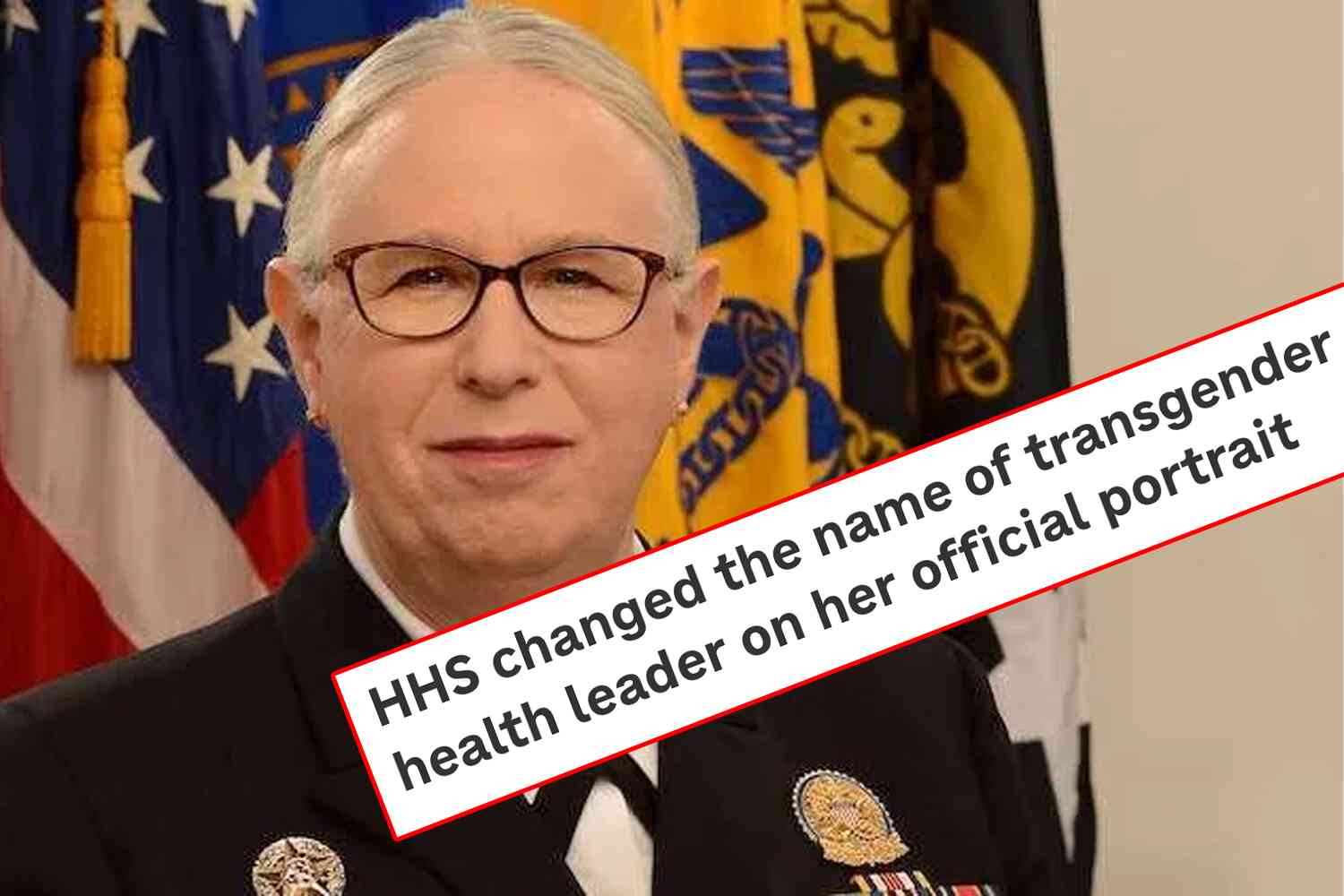

So one of the caveats to the "No Tax on Tips" law is that tips related to pornography is disallowed.

Which is a good caveat.

A great caveat!

However, that caveat is fairly targeted at one website in particular: OnlyFans, and according to a report from the New York Times, not all creators who receive tips on OnlyFans work in pornography.

‘Where's the line?' said Katherine Studley, who works with several OnlyFans creators. ‘Just because you're on OnlyFans, that doesn't necessarily mean it's pornographic.'

‘You could have a cooking channel or a yoga channel.'

Pornography has often proven difficult to define in court.

And the tax experts and law makers are claiming that in order for it to be defined, it must be viewed.

Ultimately, they say that for OnlyFans creators that submit returns claiming the tips deduction, someone is going to have to watch the content to make sure it qualifies or should be disallowed.

‘Ultimately, it would be the subjective determination of an IRS examiner or a Tax Court judge,' Thomas Gorczynski, a tax preparer, said. ‘Sometimes you look at something, and it's clearly pornography, but sometimes you look at something and you think, "Eh it's subjective."'

This wouldn't be an issue if we'd hurry up and ban porn in the U.S..

P.S. Now check out our latest video 👇